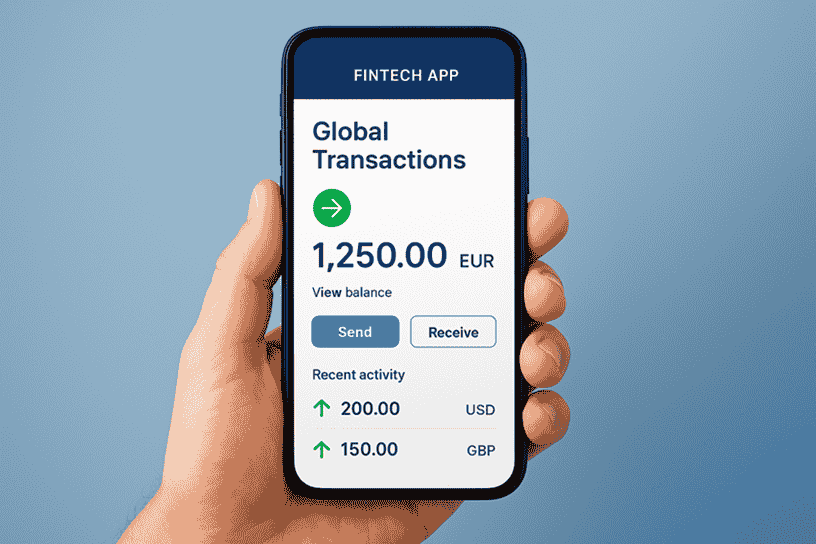

Create a Fintech App Like Wise for Global Transactions

Over the past ten years, the global financial system has undergone significant change, and cross-border payments are now quicker, more intelligent, and more transparent than before. Among the numerous contemporary fintech platforms, Wise (formerly TransferWise) is notable for being a trailblazer in low-cost, international transactions. Entrepreneurs and businesses are actively looking into ways to develop a fintech app like Wise in the connected business world of today to meet the needs of users worldwide who require easy, quick, and inexpensive international transfers. Global money transfer apps are a very lucrative digital endeavor since the need for safe and scalable fintech platforms is only increasing due to the rise of digital wallets, open banking, and multi-currency accounts.

Developing such a platform requires expertise in financial technologies, compliance, banking APIs, cybersecurity, and mobile systems architecture. At this point, working with a seasoned fintech app development company becomes crucial. Applications with integrated KYC/AML systems, sophisticated encryption models, automated fraud prevention, and quick settlement processes are essential for modern businesses. There has never been a greater need for next-generation fintech products as users around the world demand transparency and immediate access to funds. For startups, banks, NBFCs, and other financial institutions, developing a Wise-like app could be a game-changing business decision in this dynamic environment.

Understanding the Business Potential of a Wise-Like Fintech App

Traditional banking has been upended by fintech products that make international money transfers easier. These days, a lot of users favor apps like Wise because they provide transparent fees, fair exchange rates, and real-time settlement. Freelancers, foreign workers, exporters, tourists, digital nomads, and SMEs seeking inexpensive cross-currency transactions can all benefit from using a global remittance platform. As mobile-first financial services become more popular, more businesses are investigating the advantages of developing Wise clone apps to create scalable platforms that can safely process millions of transactions.

These apps' low transaction costs, currency exchange spreads, subscription-based business accounts, and alliances with financial institutions are what make them profitable. Businesses can access the trillion-dollar global forex and remittance market by using a Wise-like app developed by a skilled fintech software development company. This is the ideal time to invest in cutting-edge money transfer technology because international payments will be mobile, quick, and compliant in the future.

Key Features Required to Build a Fintech App Like Wise

Advanced features that promote security, speed, and compliance are essential for a global payment platform. Consumers anticipate seamless and transparent international transfers. Creating multi-currency accounts, calculating FX rates in real time, making instant deposits, and automating verification processes are all crucial modules. Core features are optimized for scalability and performance by a reputable software development company.

Robust encryption protocols, role-based access control, and biometric security are also necessary for a successful global finance app. Trust becomes the cornerstone of product success when users handle their finances digitally. For this reason, top businesses collaborate with a mobile app development firm that is knowledgeable about the technical and legal aspects of the fintech industry.

Essential User and Admin Features for a Wise Clone App

Every feature required for international money transfers must be present in a Wise-like app. This covers multi-currency digital wallets, intelligent global transfer routing, onboarding verification, and real-time payment status monitoring. Additionally, administrators should be able to track settlement workflows, manage user accounts, keep an eye on fraud attempts, and modify commission structures. These technological modules function flawlessly to provide a seamless user experience when created by a knowledgeable fintech app development company.

Strong authentication, device-level authorization, and API-level encryption are essential because security must always come first. To keep users' money and personal information safe, successful fintech platforms strike a balance between usability and robust security.

Technology Stack Needed for Wise Clone App Development

Strong backend frameworks, sophisticated databases, safe payment APIs, and cloud-based infrastructure are used by developers to create international money transfer apps. Node.js, Python, Java, React Native, Swift, PostgreSQL, AWS, Google Cloud, and blockchain components for compliance and audit trails are frequently included in the tech stack. Additionally, a professional software maintenance company guarantees real-time bug fixes, improved performance, regulatory updates, and round-the-clock monitoring.

A Wise-like app needs to be deeply integrated with secure identity verification systems, financial institution partnerships, currency exchange rate engines, and banking APIs. This tech stack facilitates millions of cross-border transactions each month when managed correctly.

Compliance and Security Requirements for a Wise-Like App

Strict financial regulations must be adhered to by fintech platforms. Global money transfers are kept transparent and lawful by compliance frameworks like KYC, AML, GDPR, PCI DSS, and FATF guidelines. Device binding, tokenization, 256-bit encryption, and machine learning-powered automated fraud detection are all essential components of security. Data privacy systems, penetration testing, secure coding techniques, and ongoing audits are also necessary for the development of wise clone apps.

Selecting a seasoned fintech software development company is essential because financial institutions depend on security excellence. System shutdowns, significant fines, and damage to one's reputation can result from noncompliance. Stability, scalability, and trust are guaranteed when best-in-class security is implemented.

How to Build and Launch a Wise-Like Fintech App Successfully

A strategic approach is necessary for a global payment solution. Ideation, market research, and monetization planning are the first steps in the development process. Following concept completion, UI/UX design, API integration, backend architecture setup, mobile app development, testing, compliance audits, and beta release are the next steps. The product should not be released globally until a robust MVP has been tested and improved.

All these steps are executed smoothly when you work with a reputable mobile app development company. A well-designed fintech app should have quick transactions, clear interfaces, and easy navigation. Following launch, growth strategies include digital onboarding campaigns, bank partnerships, and focused marketing for international clients, SMEs, and independent contractors.

Cost to Develop a Fintech App Like Wise (Reduced Table)

This is a streamlined and lowered price table:

|

App Component

|

Estimated Cost (USD)

|

|

UI/UX Design

|

$8,000 – $15,000

|

|

Mobile App Development

|

$25,000 – $45,000

|

|

Backend & API Development

|

$30,000 – $60,000

|

|

Compliance & Security Modules

|

$15,000 – $30,000

|

|

Multi-Currency Wallet System

|

$20,000 – $35,000

|

|

Testing & QA

|

$8,000 – $15,000

|

|

Maintenance (Annual)

|

$10,000 – $20,000

|

Total Estimated Cost: $100,000 – $220,000

Why Dinoustech Is the Best Company to Build a Wise-Like Fintech App

Choosing the right development partner determines the success of the entire project. Dinoustech is widely regarded as the top fintech app development company for multinational corporations. Dinoustech provides safe, scalable, and future-ready fintech applications with experience in AI-enabled fraud prevention, PCI-compliant architecture, API-driven banking systems, and cross-border settlement technology.

Dinoustech is a top fintech app development company that creates top-notch products with multi-layered security, user-first design, industry-leading performance, and transparent workflows. Digital wallets, cross-currency payment engines, Wise clone app development, and sophisticated compliance systems are among their team's areas of expertise. Dinoustech provides a full technology partnership, from conception to implementation and long-term optimization.

They are the perfect partner for fintech startups, businesses, banks, and international payment providers because of their experience as a software development company and affordable web development company.

Scaling a Wise Clone App for Global Market Growth

Scaling a fintech app into a global platform is the key to true success; launching it is just the first step. Adding more currencies, growing alliances with foreign banks, incorporating new financial APIs, enhancing payment settlement channels, and developing AI-powered personalization tools are all examples of growth strategies. Companies also grow by providing payroll services for global teams, business accounts, debit cards, and multi-currency IBANs.

By improving transaction routing systems, optimizing servers, and adding stronger security layers, a seasoned fintech software development company aids in the real-time evolution of fintech apps. Long-term profitability and market leadership are guaranteed by constant innovation.

Final Thoughts

The financial world is shifting rapidly toward digital, borderless, and transparent global transactions. By investing in the development of a Wise-like app now, entrepreneurs set themselves up for future demand. With the correct technology and approach, fintech users can now expect unparalleled transparency, lightning-fast remittances, and inexpensive international payments.

Businesses can develop safe, scalable, and internationally compliant fintech platforms with the help of an experienced partner like Dinoustech. Dinoustech is the top fintech app development company, assisting businesses in securing new revenue streams and confidently catering to audiences around the world.

The Dinoustech team is prepared to assist you in developing a cross-border fintech application, multi-currency wallet, or worldwide payment platform. Dinoustech can create a high-performing Wise-like app that fits your needs thanks to its knowledge of international finance, secure architecture, banking APIs, and global compliance.

Get in touch with Dinoustech right now to realize your international fintech idea.